When evaluating their defined contribution plans, clients understandably look at standard benchmarks such as rate of participation, average deferral percentage, and

Given the highly mobile nature of today’s workforce, sponsors should also consider tracking the average percentage of retirement savings that participants retain during their job tenure, and when they leave to join another employer.

The median account balance for 401(k) participants who made uninterrupted contributions between 2010 and 2014 was more than three times higher than that for all participants, according to

The EBRI/ICI research strongly indicates that the best way for a worker to achieve a financially secure retirement is to participate in the U.S. retirement system as an employee of the same company for 40 years or more, and to let their retirement savings grow untouched until retirement.

However, most American workers don’t stay with the same employer for their entire working career — EBRI estimates that the average American will change jobs more than seven times over the course of a 40-year career before retiring.

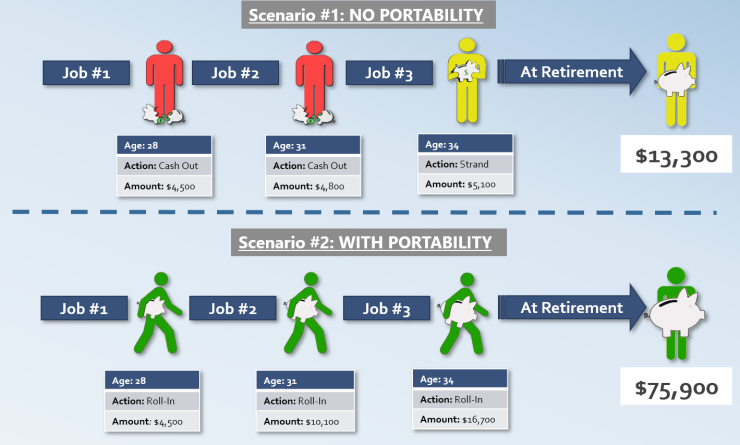

Even though very few participants stay with the same employer for four decades, they can obtain the same retirement outcomes as participants who do, if 1) they can consolidate 401(k) account savings in current-employer plans as they change jobs, and 2) avoid prematurely cashing out,

The key to achieving this success is for plan sponsors across the country to 1) adopt services that enable seamless plan-to-plan savings portability, and 2) encourage participants to preserve and move their retirement savings at the time of their job-change. Fortunately, sponsors can help their participants create “

Auto portability is the routine, standardized, and automated movement of a retirement plan participant’s 401(k) savings account from their former employer’s plan to an active account in their current employer’s plan.

Source: Retirement Clearinghouse

Going One Step Further

In addition to making internal plan changes to increase their participants’ retained savings, plan sponsors can also strengthen this metric by considering participant outcomes above all else when evaluating

Instead, sponsors should assess an ARO provider’s

As long as participants are able to quickly and easily move and consolidate their 401(k) savings upon changing jobs, and continue doing so for their entire working lives, then their savings remain intact and they can make uninterrupted plan contributions until they retire. Encouraging and enabling these participant behaviors is the next best thing to a worker staying with the same employer from the start of their working life until retirement.