It is no secret that escalating healthcare costs have drastically altered the employee benefits landscape over the years. Balancing these costs is now a constant struggle for employers across the country. Many have responded by adopting high-deductible health plans and shifting how they allocate benefit dollars.

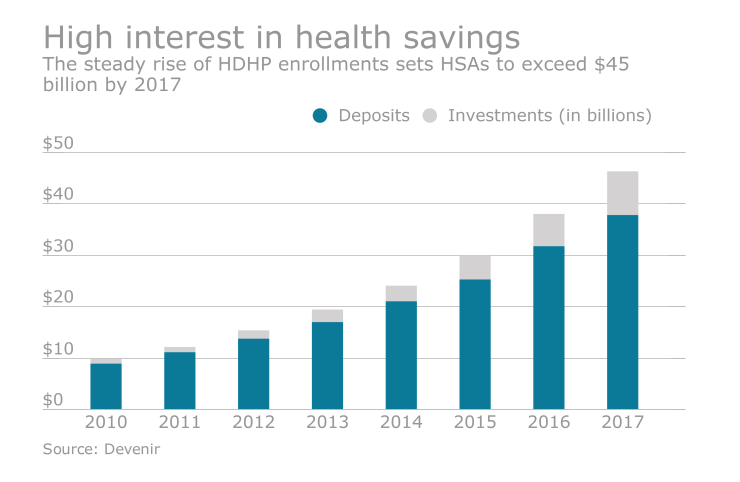

To cover the high deductibles, healthcare spending accounts, such as health reimbursement arrangements (HRAs) and health savings accounts (HSAs), have become increasingly popular during this time. They help individuals and families pay for medical expenses and provide for more control over those expenses, which encourages them to become more informed consumers of healthcare services and products.

An HSA is an individually owned, tax-favored account that allows employees to pay for qualified healthcare expenses. In order to set up or contribute to an HSA, employees must be covered by an HDHP. Although not required to contribute to employee HSAs, many employers have reduced healthcare spending even after paying some, or most, of their employees’ deductibles by contributing to their HSAs. Further, unspent HSA funds rollover each year and can be used to supplement retirement income.

An HRA is similar to an HSA; however, there are several significant differences. First, the employer owns and funds the HRA. Each plan year, the employer will determine how much money to contribute to the HRA, set the threshold for when funds are available, as well as what expenses will be considered eligible for reimbursement. Funds may be eligible for rollover, but cannot be invested.

HRAs must be integrated with a group health plan to stay in compliance with healthcare reform and cannot be offered as a stand-alone plan. HRAs are often paired with an HDHP, although this is not a requirement.

Giving employees the option to choose between a standard HRA or HSA is great for reducing healthcare costs for the employer, but it’s unlikely one plan will meet all employee needs. One simple — but underutilized — method for expanding the employee benefits offering is to adjust a standard HRA to make it HSA qualified.

There are four HRA plans that are compatible with an HSA:

1. Limited purpose

2. Post-deductible

3. Retirement

4. Suspended

There are several advantages to using both an HRA and HSA, such as lower health insurance premiums, greater control over employer contributions, flexibility on plan designs, as well as additional tax savings.

Moving into 2018, all trends indicate consumer-directed plans will continue to grow in popularity. As more employers offer HDHPs alongside HRAs and HSAs, it is important to stay ahead of the competition by taking the necessary steps to maximize all available tax advantages.

Further, competitive employee benefits packages can be a prime tool for recruiting and retaining top talent.

While combining an HRA and HSA is only one method for reducing healthcare costs and improving the employee benefits offering, it is nevertheless an important step for achieving sound financial wellness and recruiting/retaining top talent in 2018.