Millennials, ages 22 to 37, are now the largest generation in the workforce. According to a

One of the most important considerations for benefit advisers with clients that have younger workforces is how best to help these younger workers prepare for retirement. They have different financial needs and communication preferences than older generations, and advisers need to adapt their tactics to account for these differences.

Here are three ways to help younger employees grasp the importance of a retirement plan and making early contributions:

1. Encourage them to live for the future and not just the present.

With retirement decades away, few millennials give it serious consideration at this point in their careers. While their individual financial priorities vary, younger people tend to live in the moment and have yet to gain the knowledge and forethought that successful financial planning requires.

To compensate for this, advisers should make the case for early retirement contributions by emphasizing that even small amounts—like a few hundred or thousand dollars a year—can dramatically improve their financial wellbeing over the long haul. A good approach is to include visual aids and simulations to illustrate how regular contributions will increase their future returns.

2. Present budget strategies that help them balance their financial obligations.

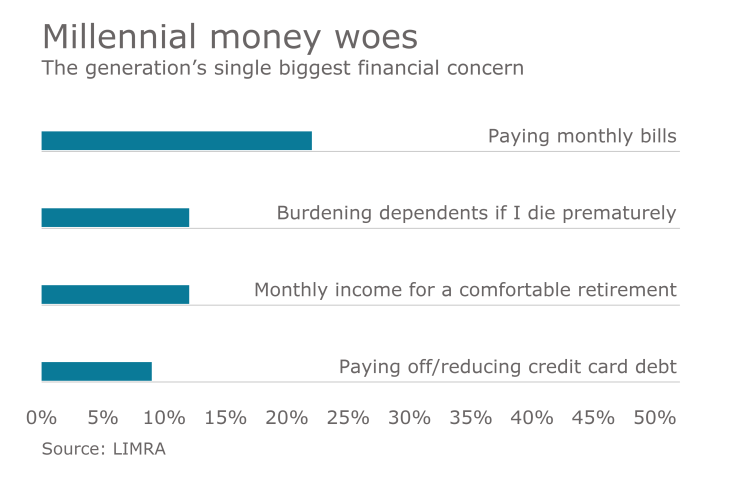

Young professionals must balance their existing obligations—such as student or car loan payments—with their long-term needs and saving for the future ahead is typically low priority. For example, a

To help correct this, advisers should help younger employees factor retirement savings into their existing budgets. A graduated or tiered retirement savings model is one such approach. This allows for their contributions to increase over time as their salaries grow and they pay down their current obligations.

3. Improve younger professionals financial literacy to build their confidence and independence.

Younger professionals have yet to gain the experience and financial savvy of their older colleagues. Advisers can help get them started by encouraging them to ask questions and pointing them towards easy-to-understand educational materials that cover the basics. Links and lists of such neutral resources can be offered up in employee welcome kits, introductory communications and in-person meetings.

A hands-on approach is the best way to help millennials overcome their retirement savings challenges. Advisers who take the above steps can build younger employees’ confidence and determination to secure their financial futures.