As concerns about employee financial well-being and retirement readiness continue to grow, 401(k) plan sponsors are adding a key feature to their 401(k) plans that provides some flexibility to savers: the option for Roth 401(k) contributions.

Roth 401(k) contributions turn the tax treatment of traditional 401(k) plan contributions on its head. Instead of the traditional 401(k) pre-tax contributions that are taxed upon withdrawal in retirement, the Roth feature allows participants to make after-tax contributions, which can be withdrawn tax-free in retirement.

As a retirement planning tool, Roth 401(k) contributions can offer 401(k) plan participants a more nuanced approach to retirement saving than a traditional 401(k) plan can on its own. The different tax status of Roth 401(k) withdrawals gives plan participants more flexibility and opportunities to broaden their retirement planning strategies and turbocharge their retirement plan outcomes.

The promise of Roth 401(k) contributions is becoming clearer to many plan sponsors. Willis Towers Watson’s 2017 Defined Contribution Plan Sponsor Survey found that the availability of the Roth 401(k) feature has grown from 52% of plans in 2014 to 70% in 2017. Another 15% of plan sponsors are planning to add the Roth feature or are considering doing so.

Looking to maximize the Roth promise

Plan sponsors should understand that most 401(k) plan participants won’t realize the full promise of the Roth 401(k) feature on their own. Plan sponsors need to provide engaging communication about how the Roth feature works, how it impacts retirement saving and planning, and how participants can maximize the impact of their Roth contributions.

The majority of 401(k) plan participants, accustomed to the features and decision making involved in traditional 401(k) plans, may not immediately understand how the Roth feature can help diversify their retirement planning or how they can leverage it to improve their retirement saving strategies.

Whether to make Roth 401(k) contributions is right for a given employee will depend on age, current income level and projected income level in retirement. By offering planning advice and modelling tools, employers can help employees decide how the Roth 401(k) should factor into their retirement saving.

Showing the impact of the Roth

The most compelling aspect of the Roth 401(k) is the tax treatment of those assets.

Tax-free Roth 401(k) withdrawals may eliminate one of the two key variables in retirement planning —the retiree’s tax rate in retirement. Only inflation causes as much uncertainty and concern for future retirees.

Roth 401(k) assets will not be reduced by taxation as long the Roth 401(k) account is at least five years old and the retiree is at least age 59 and a half, has become disabled or dies.

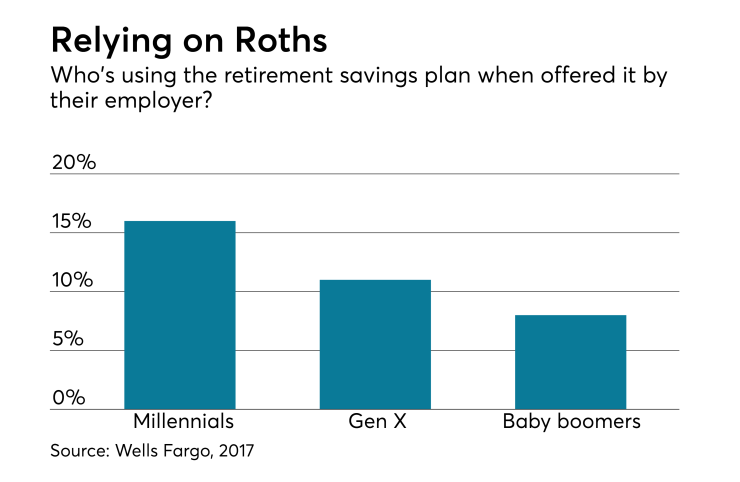

For an older worker making retirement income calculations, this lack of retirement taxation on Roth 401(k) assets can be a compelling planning tool. We believe younger employees can also be particularly good candidates for a default Roth 401(k) since they tend to be in one of the lower tax brackets and have enough years before retirement for the returns on their Roth 401(k) assets to make up for the taxes they paid on those contributions.

Offering more

Offering the Roth feature in a 401(k) plan for new contributions can be just the starting point for employers. The potential benefits of Roth 401(k) contributions are so powerful that employers may want to consider splitting the contribution types for default enrollment between traditional 401(k) contributions and Roth 401(k) contributions.

Another option is to allow in-plan Roth conversions, in which participants convert their existing traditional 401(k) plan accounts to a Roth 401(k). Currently, 37% of plan sponsors offer in-plan conversions and another 23% are considering allowing them in the future. Among those allowing conversions, 55% allow participants to convert all of the money in their accounts.

Because such conversions require participants to pay taxes on their original 401(k) plan contributions, employees are likely to need some level of support as they calculate the immediate tax cost of a conversion vs. the long-term non-taxable withdrawals they will enjoy in retirement.

Helping employees to use the Roth

One final survey finding from our recent defined contribution study offers important insight about employee awareness of the Roth 401(k) and its potential. Among those plan sponsors that do not offer the Roth 401(k) feature, 70% cite low demand for it among employees as the reason. Even employers that do offer a Roth 401(k) are likely to see some “lack of demand” for a Roth feature among their participants.

That’s why we believe helping employees to understand the feature and how it fits into their retirement planning is so important. Only by assessing how Roth 401(k) can help them maximize their individual retirement outcomes can participants make the most of it.