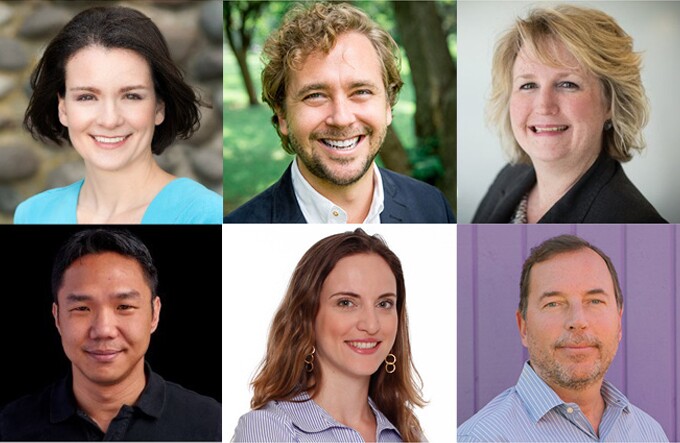

Meet EBA's 2018 Digital Innovators

July 5, 2018 4:03 AM

Employers can promote a healthier, more productive workforce thoughtful wellness offerings

An employee training expert explains what's missing from organizations' training structures and why it may cost them in the long run.

Fortune and Great Place to Work analyzed 1.3 million survey responses, ranking the best companies in the U.S.

The nation's largest business lobby argued that the FTC lacks the authority to issue rules that define unfair methods of competition.

The ban prohibits workers from switching jobs within an industry.